End of year review 2025

Uncorrelated Strategies Fund

This is a marketing communication for professional investors only. Capital at risk.

Past performance does not predict future returns.

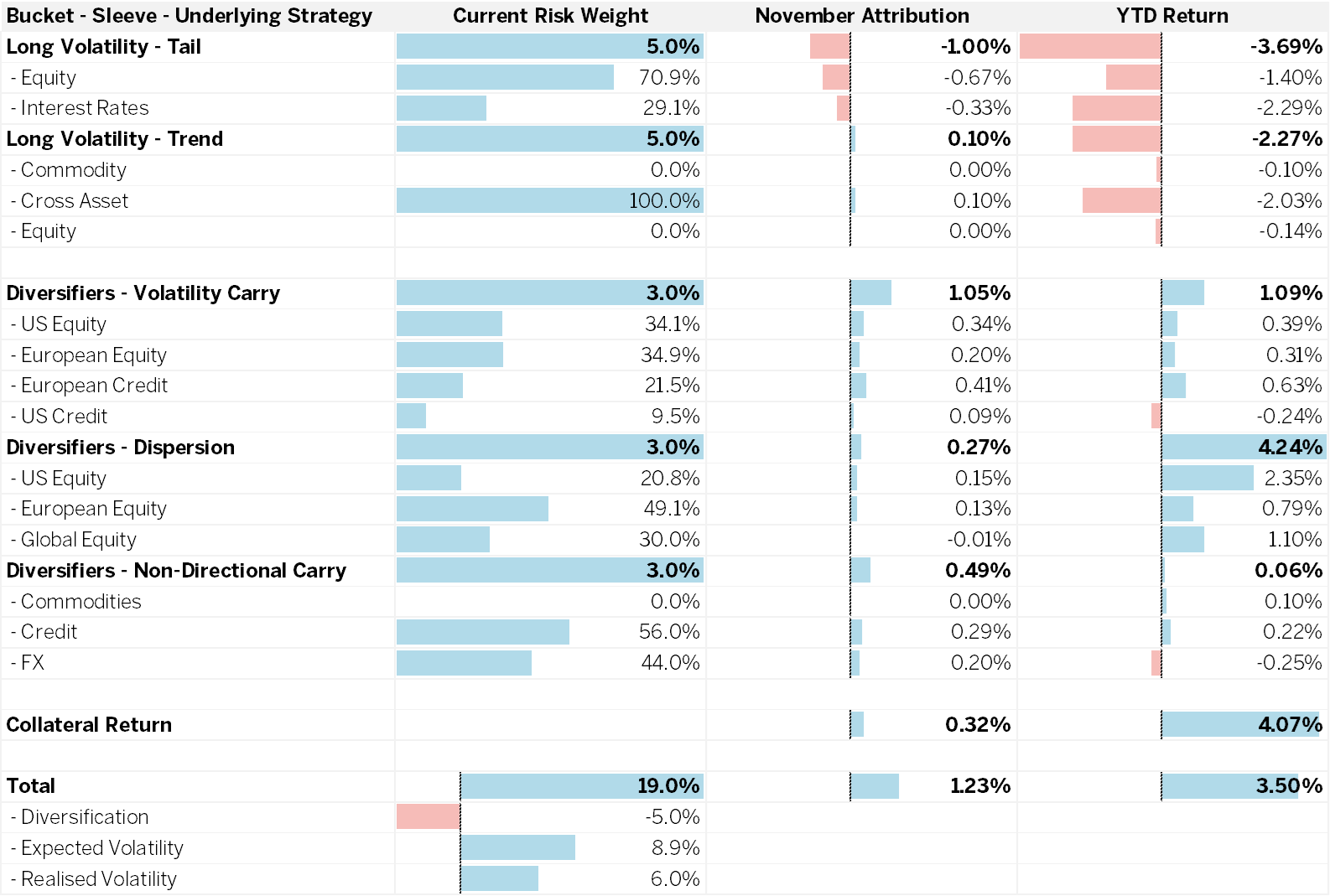

The AHI Uncorrelated Strategies Fund posted a positive return for the year, returning 3.50% to the end of November. The year was a tale of two halves, with the liberation day volatility posing something of a ‘worst case’ scenario for the strategy – that being extremely short burst of volatility which recovers within a 2 day period - whilst the remainder of the year was characterised as a healthy playing ground for the strategy with risk premia remaining rich for the rest of the year. The strategy did particularly well from dispersion trading with the ‘AI’ boom creating very clear winners and losers.

Performance summary

-

Strong performance from Dispersion

-

Underperformance from Trend amidst high policy volatility

-

Rich risk premium remains and fund in strong position to capitalise

Source: Atlantic House as at 30/11/25.

Overview of the year

The fund entered the year with the return of Donald Trump to the White House. The market had responded to the re-election with optimism as the President promised to return to his previous agenda of tax cuts, and deregulation. However, the market did not anticipate the administrations agenda of using tariffs in as widespread a fashion as they were soon implemented. The tariffs which were implemented in early April served to rearrange the world order of trade and caused major issues for systematic strategies as correlations broke down, markets became illiquid even within the most liquid asset classes, such as US Treasuries, and global investors shunned US assets.

Within this episode of volatility there were two main sleeves of the fund which struggled. Volatility Carry suffered losses as equities saw the largest moves they have seen in COVID. This was not surprising to us, and whilst there was a loss in that sleeve, the trade implementation served to limit the downside by hedging on a more frequent basis and restriking positions as volatility rose. The second sleeve to suffer a loss was Trend which was served a double hit as the market fell after a period of strong performance, into a crash of correlation breakdowns across government bonds in Europe and the US – only to be reversed 3 days later as the tariffs were called off and countries began to come to the negotiating table.

The fund reached the point of max defensiveness the day before the tariffs were called off and would have stood to generate outsized returns if the market volatility had continued. However, the administration decided that the market volatility was too much in calling off the policy.

This volatility did, however, have a lasting impact in volatility markets. Implied volatility in equities and credit has remained elevated since the liberation day episode which has allowed the volatility risk premium to remain healthy. Something the strategy has captured, with the volatility carry sleeve regaining all the loss in April.

The other standout sleeve has been dispersion. The AI boom has created a clear divide between the ‘winners’ and ‘losers’ within the AI complex. This should perhaps be shown as ‘earning’ AI dollars, or ‘paying’ AI dollars. The spend on AI has been enormous with almost all of the growth in capex in the S&P going towards AI spend. This has led to a huge amount of dispersion between single stocks within the index which the strategy has been able to capture, posting strong returns for the year.

2026 outlook

Looking forward, the strategy is entering a year positioned for a cross-asset environment defined by rising divergence of companies, and potentially unstable macro trends. We have made improvements in the way we implement both volatility carry and trend to make them less susceptible to idiosyncratic policy volatility, whilst still allowing them to capture the rich risk premia which remains in the market. Dispersion is expected to widen as fundamentals decouple across sectors allowing for continued performance in that sleeve. Finally, pairing all the above with targeted long volatility positions to provide convex downside protection sets the fund in a strong position to navigate 2026.

We remain focused on:

-

Implementing each sleeve in the optimal way for the current market environment

-

Taking opportunistic positions in dispersion trades to continue the performance we’ve seen in 2025

-

Pairing our carry positions with strict risk management

-

Maintaining our scenario analysis to provide outsized returns in the bleakest of market scenarios

This is a marketing communication. The fund is aimed at advised & discretionary market investors over the long term who have the capacity to tolerate a loss of the entire capital invested or the initial amount.

A final investment decision should not be contemplated until the risks are fully considered. A comprehensive list of risk factors is detailed in the Risk Factors Section of the Prospectus and the Supplement of the fund and in the relevant key investor information document (KIID). A copy of the English version of the Supplement, the Prospectus, and any other offering document and the KIID can be viewed at www.atlantichousegroup.com and www.geminicapital.ie. A summary of investor rights associated with an investment in the fund is available in English at ww.gemincapital.ie.

Please be aware that past performance is not indicative of future performance. The value of investments and income from them can go down as well as up, and you may get back less than originally invested.

Equity Risk: The fund has exposure to equity markets. The value of equities can rise and fall.

Counterparty Risk: The risk that a counterparty will not fulfil its payment obligation for a trade, contract or other transaction, on the due date.

Currency Risk: The fund holds assets denominated in other currencies, the value of which may rise and fall due to movements in exchange rates.

Interest Rate Risk: The fund’s investments are sensitive to changes in interest rates.

Operational Risk: The risk of direct or indirect loss resulting from inadequate or failed processes, people and systems including those relating to the safekeeping of assets or from external events.

Credit Risk: The risk the issuer of the bond fails to make interest or capital payments.

Liquidity Risk: The risk that the fund may be unable to sell an investment readily at its fair market value. In extreme market conditions this can affect the fund’s ability to meet redemption requests upon demand.

Derivatives Risk: The fund is permitted to use certain types of financial derivatives to achieve its objective. The value of these investments can rise and fall depending on the value of the underlying instrument. There is also a risk that the counterparty to these derivatives fails to meet its obligations.

For full information on these and other risks, please refer to the fund prospectus and offering documents, including the KID or KIID, as applicable.

The information contained in this communication is general information only and has been prepared by Atlantic House Investments Limited (“Atlantic House”), a Corporate Authorised Representative of Mantis Funds Services Pty Ltd (ABN 97 649 083 689; AFSL 531027) and is provided only for the information of Australian sophisticated investors who qualify as "wholesale clients" under section 761G of the Corporations Act.

Equity Trustees Limited (‘EQT’) (ABN 46 004 031 298; AFSL 240975) is the Responsible Entity for the AHI Defined Returns Fund (the Fund), which is an unregistered managed investment scheme managed by Atlantic House and Mantis Funds Pty Ltd (ABN 77 640 207 021) (Authorised Representative No. 001281645) ("Mantis"). Mantis is a corporate authorised representative of Mantis Financial Group Pty Ltd (ABN 94 614 846 963) (AFSL 492452)

The information in this communication is not financial advice and is not to be used as a basis for making any investment decision. It is not intended to take the place of professional advice and does not take into account your investment objectives, financial situation and particular needs. You should not act on this information or any other information provided to you in relation to the Fund without first consulting your investment. taxation and other relevant advisors and reading the relevant product disclosure statement or other offer documents. Nothing in this communication shall be construed as a solicitation to buy or sell a security or to engage in or refrain from engaging in any transaction.

Whilst Atlantic House believes that the information contained herein is correct at the time of compilation, none of Atlantic House, Mantis, Mantis Funds Services Pty Ltd, Mantis Financial Group Pty Ltd or EQT provide any representation or warranty that it is accurate, complete, reliable or up to date. Nor do any of Atlantic House, Mantis, Mantis Funds Pty Ltd, Mantis Financial Group Pty Ltd or EQT accept any obligation to correct or update the information in this communication. The information in this communication is subject to change without notice. Atlantic House, Mantis, Mantis Funds Pty Ltd, Mantis Financial Group Pty Ltd and EQT do not accept any liability whatsoever for any direct. indirect, consequential or other loss arising from any use of the material contained in this communication. Information in this communication may refer to the past performance of a person. entity or financial product. Past performance is not a reliable indicator of future performance.